Since the launch of TERS, there has been (almost) daily changes introduced by the Unemployment Insurance Fund. Important amendments to TERS were gazetted on 8 April 2020. Following those amendments, the Minister of Employment & Labour signed off on further amendments and corrections on 16 and 20 April 2020, respectively.

In addition to these changes, the UIF has also publicly released the method of calculation for TERS benefits. We highlight 5 important updates on TERS for employers below.

1. New changes

Although not yet been gazetted, these changes do clarify various questions on TERS –

At this stage, employers can only apply for the current lockdown period (ie 35 days). However, with a possible extension of the lockdown for certain employers, it may be possible for employers to claim TERS benefits for that period (up to a maximum of 3 months). The UIF has confirmed that employers will be able to apply for TERS benefits for the current period of the national lockdown (i.e. 35 days) after 30 April 2020.

Employers who are not able to operate during the level 4 lockdown may be entitled to claim TERS benefits for the extended period. However, it remains to be seen whether this will actually be the case as the online application process only allows for claims for the current lockdown period.

3. Employers who pay full salaries of employees

Employers who pay full salaries of employees during the lockdown period may qualify for TERS benefits provided that they have paid employees the equivalent of the TERS benefits in advance of receiving payment by the UIF.

The advance payment should be recorded by the employer in some manner (for example, on the payslips of employees or a recordal for internal purposes).

4. Method of calculation for TERS benefits

The TERS benefit per employee will be calculated by the UIF in accordance with the rules of the scheme and by the UIF applying the Income Replacement Rate (IRR) to the employee’s daily income. The IRR will range from 38% – 60% depending on the employee’s daily income. In order to calculate the TERS benefit per employee, the table below should be used as a guide :

5. Upgrades to online application process

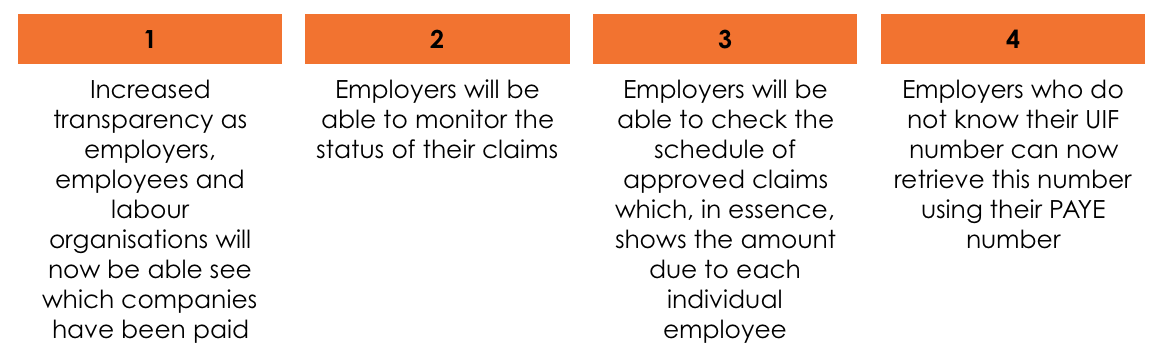

The UIF has recently introduced various upgrades to the online application process to make the process more efficient:

The success of a TERS application depends on various factors including the format and date of your application and number of employees included in your application. The UIF is currently inundated with TERS applications. The UIF has said that for applications that meet the requirements, the employer should be paid within 10 business days.

If employers would like to follow up on the status of their TERS application, they can contact the UIF as follows –

- TERS call centre: 0800 030 007

- Email: [email protected]

- Website: www.uifecc.labour.gov.za/covid19

TERS continues to be ever evolving. Given that it is new fund established by the UIF on tight timelines, there were bound to be teething issues. Slowly but surely, we are starting to see that the fund is operating more accurately and efficiently and most importantly, in line with its overall purpose of helping employees to avoid losing income during this difficult time.

Joon Chong, Dhevarsha Ramjettan, Johan Olivier, Shane Johnson, Bianca Viljoen, Zipho Tile from Webber Wentzel.