A bleak outlook for SA employees

South Africans are among the most indebted people in the world, with as much as 73% of disposable household income servicing debt repayments. We find ourselves in an environment of rising interest rates, high levels of unemployment, and escalating food and energy prices. Many people are facing extraordinary financial headwinds and struggling to service their debt on home loans, vehicle loans, credit cards and overdrafts.

Many people are also utilising informal credit arrangements with high interest rates.All of this paints a bleak picture for the average person, even if they are fortunate enough to have formal employment.

In desperate times employees may look to their employers to award salary increases well ahead of inflation to help them make up the monthly shortfall which occurs when debt repayments start to dominate monthly spending.

How are salary increases determined?

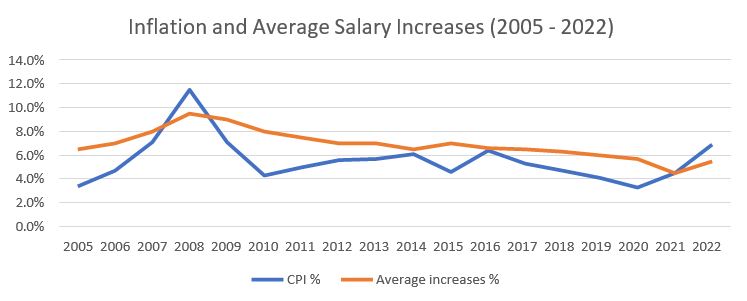

Is it the responsibility of employers to award increases in-line with, or even ahead of, inflation? Historically, companies in South Africa have awarded salary increases which are higher than inflation. The graph below illustrates this trend from 2005 to 2022. There are two years that bucked this trend, namely 2008 and 2022. Both years were impacted by extraordinary global events. In 2008 the global financial crisis caused inflation to surge ahead of salary increases.

In 2022 we experienced the effects of COVID-19 induced supply chain disruptions and pent-up consumer demand, pushing inflation ahead of average salary increases.Most companies use a combination of factors to determine annual increases, not just CPI. These are the factors most often considered:

Market salary movements

The actual and anticipated salary increases in the general market and in the specific sector in which the company operates.

Market position of employees

If a company has lost ground to their peer market in terms of overall market position it may need an extra increase budget to strengthen the position.

Key skills

In a competitive market, where key skills are hard to come by, a company may need to allocate additional budget to retain the skills which are critical to success. A business which employs a high proportion of knowledge workers may need a higher increase budget because the skill set they employ is receiving above average increases in the market.

Impact of union negotiations

One of the roles of a trade union is to negotiate competitive salary increases for their members. There are times when a company will need to exceed the budgeted salary increase because of potential industrial action which could lead to lost production and loss of income for employees.

Company affordability

The salary bill of any company makes up a significant portion of operating expenditure. As with a personal budget, a healthy company budget will plan to have income exceed expenditure. The salary cost will need to be managed within set parameters and this may mean that a company cannot afford to award the level of increases in the market.

Company performance

Salaries are a fixed cost. Once an increase is awarded the cost is locked in for the future. The only way of “undoing” this would be to retrench employees, and this would be a last resort for a company. If a company is performing well and has a positive outlook for the next three to five years, the Remuneration Committee may be more inclined to award competitive increases than if the company is struggling to meet its targets.

Individual performance

In a pay for performance environment, one would expect high performers to receive a higher portion of the increase budget. There are times when a significant portion of the increase budget is not available for performance related increases due to union settlements or a lack of managerial willpower to significantly differentiate increases. Additional budget may then be required to reward the high performers, and this will increase the overall cost.

Inflation

CPI is an indicator of the increase in the cost of living for the average employee. It is a good reference point of the level of increases needed for employees to maintain their standard of living.It is important to note that CPI is a backward-looking indicator whilst increases are awarded for the year ahead.

Companies are therefore making future focussed decisions based on historic information. An important additional indicator is for companies to consider CPI forecasts from reputable firms. Financial

services companies typically have well established economic units who publish forecasts based on their extensive research and knowledge. By looking at the average of five or six such forecasts the company will have a good picture of what will happen with inflation in the year ahead.

The impact of higher interest rates

The South African Reserve Bank Monetary Policy Committee (SARB MPC) fulfils its mandate to protect the value of the rand by keeping inflation at acceptable levels.Monetary policy is the means by which central banks manage the money supply to achieve their goals. The SARB mostly uses interest rates to influence the level of inflation.

Inflation has ticked up steadily in the last two years, mainly driven by COVID-19 related effects. The MPC left its key repo rate unchanged at a 14-year high of 8.25% during its July 2023 meeting, marking a pause in its tightening cycle after 10 consecutive rate hikes.

These interest rate hikes have significantly impacted the cost of repaying loans, and this has been felt by the average South African consumer.As an example, a person with a bond of R1.5m, a car loan of R300,000, and a personal loan of R50,000 is now paying approximately R5,438 more per month on loan repayments, compared to November 2021.

That person will need to earn R8,915 per month more at a gross level to have the extra R5,438 after tax. That is more than a R106,000 per year.

The interest rate hikes will have left the average South African employee in a difficult position. Employees have two alternatives to deal with these challenges:

a) Cut expenses so that more disposable income is available to service debt.

b) Trying to increase their income.

Moving jobs for higher pay is one way of achieving this, but not everyone is able to get a new, higher paying role. Many employees will therefore hope that their annual salary increase will be well above inflation. Unions will also be looking for double digit increases to give their members some relief.As mentioned above, companies consider a variety of factors when deciding on the annual increase budget.

Interest rates have risen dramatically in the past two years, but it is unlikely in the short-term that annual increases are going to be far ahead of inflation. Just like their employees, companies have also experienced headwinds in the last three years.

The economic impact of COVID-19, load shedding, societal unrest, and rising input costs have left many organisations as buffeted as their employees. Ultimately, company affordability and overall company prospects will be the biggest drivers of salary increase budgets in the foreseeable future.

Kirk Kruger is a member of the South African Reward Association.