As many pundits predicted, the Minister of Finance today announced a new 45% tax bracket for individuals which will apply to taxable income in excess of R1.5 million.

The tax rates below that have remained unchanged and the income levels at which they apply have been slightly adjusted, but not enough to offset the effects of inflation.

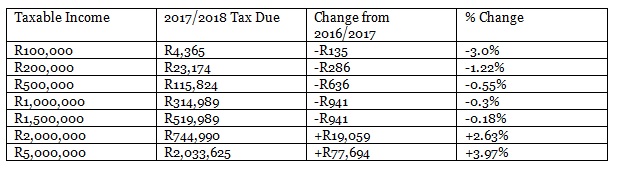

By way of example, the impact of the tax changes at the various income levels will be as follows:

According to the Minister of Finance, the impact of the tax proposals are that the additional revenue for the Fiscus from personal income tax is R16.5 billion while the introduction of the new tax bracket will result in additional revenue of R4.4 billion.

These new tax rates, combined with increases in the fuel levy as well as the usual increases in “sin taxes” will hit certain sectors of the economy quite hard. Certainly, taxpayers with taxable income in excess of R1.5 million will find themselves significantly worse off.

Barry Knoetze is the Associate Director at PwC Tax Services.