In order to attract and retain talent it is vital to monitor local national salary trends in all the locations where you operate. ECA’s Research Analyst, Charlotte Harris, reports on the key findings from this year’s Salary Trends Survey.

The general outlook

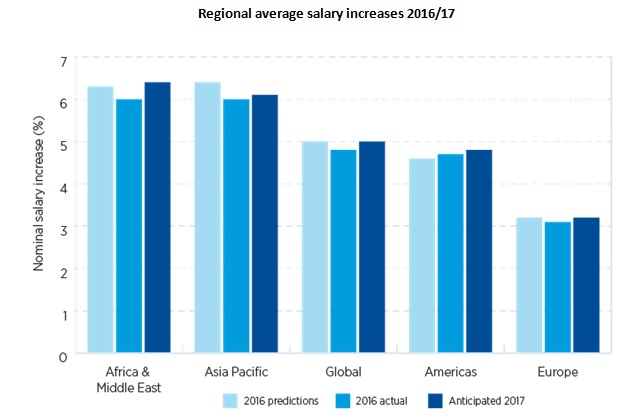

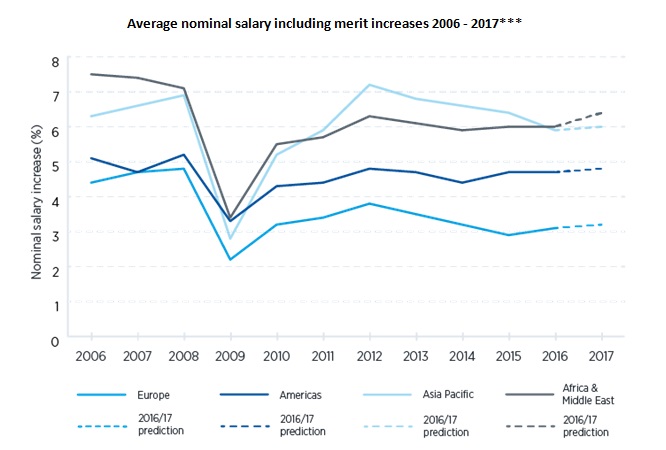

ECA’s latest Salary Trends Survey found that salaries around the world have increased by 4.8% on average* for local staff this year. At the time of the 2015/16 Survey, the forecast global average salary increases for 2016 were 5.1%. The limited difference between the forecast and actual global averages for 2016 suggest that, once again, global events have not had a significant impact on salary increases this year. Looking to next year, similar global increases are forecast, with 5% nominal increases anticipated.

Overall, the predictions made last year were generally accurate, with 71% of predictions within 0.5% of the actual median increase. However, companies in the Asia Pacific, Europe and Africa & Middle East regions revised their salary increases for 2016 down from the predictions made in 2015. The biggest change to last year’s predicted values came from China and Nigeria, where in both cases salary increases are 1.5% lower than expected; followed by Indonesia and Kuwait, where salaries are 1.4% lower than anticipated.

Expect the unexpected

As can be seen from the chart below, nominal wage increases in China are at their lowest level since 2009, when salary increases for local staff dropped to a low of 3.1% in reaction to the global financial crisis. Growth in China has continued to slow this year, resulting in an unexpected drop in salary increases for firms in China, who had last year anticipated increases of 8% for employees in 2016. Salary increases for local staff have hovered around 8% since 2011, before dropping this year to 6.5%.

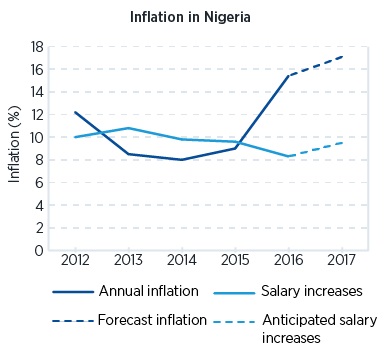

The Nigerian government’s decision to float the naira earlier in 2016, to depreciate the elevated currency value, has added to soaring inflation. The impact of this may well mean companies have to reduce their salary increases for local staff to meet rising costs. While employees will still receive a nominal wage increase, they will feel worse off due to the higher than predicted level of inflation.

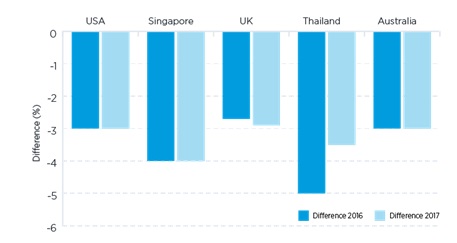

In both Europe and the Americas, the difference in predicted and actual wage increases was minimal, reflecting the general stability in these regions. Even for companies in Venezuela, it seems that business decisions have been maintained despite rampant inflation, as the salary increases given in 2016 matched those predicted in last year’s survey. Following the UK’s decision to leave the European Union, inflation in the UK is expected to increase from 0.7% in 2016 to 2.5% in 2017, meaning local staff could expect a minimal real wage increase of 0.3% next year, as nominal increases are expected to average 2.8%. Inflation is likely to be revised upwards for 2017, but it is less likely that wage increases will also be revised upwards. It is important to note that sudden increases in inflation, as witnessed in Russia in 2015, do not necessarily lead to companies re-evaluating their strategy straight away. Our interim Salary Trends Survey for Russia in 2015 found that companies planned to monitor the situation before making any changes and, despite the sudden jump, inflation cooled and returned to more normal levels without any major changes to salary increases.

The impact of inflation

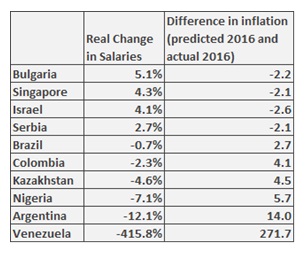

When budgeting employee salary increases for the following year, companies may base decisions on productivity, performance, competitor increases or government regulations. However, inflation can have a significant impact on the real wage increases local staff receive. So, when budgeting employee salary increases for the following year, inflation should also be taken into consideration. The table shows the top 10 countries where inflation predictions** made in 2015 for 2016 have differed the most compared to actual inflation in 2016, and the real increases that local staff have received. A large unexpected rise in inflation can leave staff worse off, a lot worse off in the extreme case of Venezuela, whereas lower than expected levels of inflation can mean staff are significantly better off, as in Bulgaria.

Lower than predicted inflation

Almost a third of the European countries surveyed have experienced deflation in 2016. In Bulgaria, despite predictions in 2015 for inflation to increase to 0.6%, the country experienced deflation of 1.6%, extending the period of deflation since 2014. Inflation is expected to rise in 2017, so local staff will not feel as well off as they do this year.

Singapore is the only country surveyed in the Asia Pacific region to experience deflation in 2016. Real wage increases here remain marginal due to the low nominal salary increases offered by local organisations, which continue to sit below the regional average.

Interestingly, employees based in Israel, who were forecast last year to receive average salary increases below the regional average, are in fact now receiving the highest real wage increases in the region. Unexpected deflation in the country this year resulted in nominal salary increases far higher than the inflation rate.

Higher than predicted inflation

Inflation in Argentina appears to be calming. Data from Consensus Economics suggests that inflation is slowing, albeit to 20.5% in 2017. This fall will be enough for local staff to expect real salary increases of 6.5% on average in 2017, after a pay cut in real terms of 12.1% this year. In contrast, inflation in Venezuela is increasing at an alarming rate. Inflation has been forecast at 476% for 2016 and this is expected to increase to 1660% in 2017. Despite average salary increases of 60% this year and 90% forecast next year, local staff in Venezuela are becoming increasingly worse off.

The devaluation of the tenge and resulting rising import costs have meant that inflation has soared in Kazakhstan this year and local staff have experienced real salary cuts of 4.6%. Inflation is set to ease slightly in 2017, but it will remain at an elevated level, so local staff can still expect to be worse off in 2017.

The outlook for 2017

Overall, real wage growth is expected across all regions in 2017. The global average rise in real wages is expected to decrease slightly, from 1.6% in 2016 to 1.5%. While staff in Europe and Asia Pacific can still expect reduced real wage growth in 2017, staff in Africa & Middle East and the Americas will be better off in real terms next year. This is largely due to an expected fall in inflation in Latin American countries. However, as demonstrated, shocks to the economy can result in inflation predictions being inaccurate.

For now, wages are continuing in a period of steady growth, with the average regional nominal salary increases having almost recovered to pre-financial crisis levels. While the Asia Pacific region has recovered particularly well, Europe has not quite reached the level of increases experienced before 2008, instead settling at a lower level. With growing uncertainty in Europe, in particular due to the United Kingdom deciding to leave the European Union, it seems unlikely that wage increases will recover to pre-2008 levels in the near future.

Energy, mining and petrochemicals sector

The energy, mining & petrochemicals sector has based salary increase decisions on the general performance of the relevant industry, rather than inflation. The trend to offer below-average salary increases has continued and intensified this year. For the countries shown below, the median salary increase has in fact been a salary freeze, while for other industries in the specified countries, the median increase has been positive.

Sourced from ECA International.

Definitions

Including merit – the total increase in salary, including inflation/cost of living increases plus performance/merit-related increases

Nominal increase – the including-merit increase in salary

Real increase – the nominal increase in salary minus the increase in inflation

Notes

* Excluding Argentina, Venezuela and new countries to the Salary Trends Survey

** Inflation data collected from IMF Economic Outlook October 2015 and 2016

*** Anticipated 2017 increases